Financial Lifebook Session Details

Session 8

Financial Essentials for Children

Our goal in the children’s series is to help children understand the difference between wants, desires, and needs. We will help them develop an understanding of the value of money and learn that in earning money there is a trade off, in most cases we give up some of our time to earn money. When they grasp this concept, they will make wiser choices when spending their money and form a greater appreciation for the items they purchase. Children will also learn the value of saving and giving to charity.

Things such as

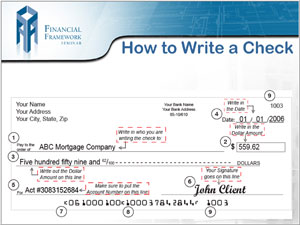

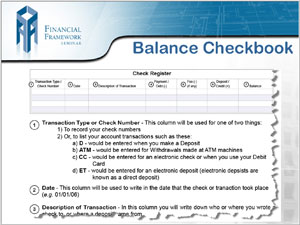

- How to balance a check book.

- How to pay bills.

- Other basic skills needed to survive.

And for you:

- What is the best way to set up a savings account for your children?

- Protecting the funds until they are responsible and knowledgeable enough to handle their money.

- What about their needs for college?

This session will provide information to allow you to make informed decisions in order to answer these questions. In addition to this class, in the first quarter of 2010, FFSS will introduce three programs for your children from age 8 to college.

Building Blocks™

This series is aimed toward children ages 8 to 13. We believe it is important to teach children about the importance of money and saving from an early age. This course will focus on the basic terms associated with money and finance, understanding the value of a dollar, learning the importance of saving, and much more. Sessions will involve hands on exercises, workbook lessons, and instruction.

Wallet Wisdom™

This series is aimed toward teenagers 14-18. It is during high school that most people start their first job and become responsible for small personal finances for things such as gas, cell phones, and entertainment. It is important for them to understand the value of a budget, saving, and planning for the future, and how to pay and manage bills. During this series we will focus on creating and managing a personal budget, different options for saving money, ways to finance college expenses, and much more.

Cash Concepts™

This series is aimed for college students and young adults who may be just starting out on their own and managing their own bills such as car payments, rent, groceries, etc. This series focuses on budgeting, saving, and understanding financial terminology to help them function on their own. We will touch on subjects such as renters’ insurance, student loans, buying your first house, managing your finances, and saving for the future.

It is important for children to learn that money does not simply appear. Something has to be traded for it. Usually time and labor are the bartering tools for money. Handing an allowance or money over to a child without them earning it will not help them understand the value of money or how money is earned. It is important for children to understand that getting money is by a trade, you give your time by working at an agreed upon task. This is something all of us can teach our children at a young age. Use yourself as an example. You go to work to earn money and are paid for your labor and rewarded for your level of performance. Children should learn the difference between doing a job adequately and doing a job superbly. As children become young adults they will begin to grasp the relationship between time and money.

The Financial Framework™ for Children, Teens and Young Adults are all set up so the money lessons your children learn are not just information from a text book but through lessons from life. They will have lessons and activities that fit into their daily life routine and you will be a big part of teaching that lesson. Your involvement is vital. We have suggested guidelines and activities, but you will set the actual guidelines that are best for your family. The goal is to have your children develop good money habits that they will use from early childhood throughout their life. Consistency is important for developing a habit so, YOU must be involved creating the consistency.