In this Section

Why Be Debt Free

Why is it so important to be debt free before retirement?

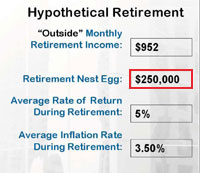

To illustrate the importance of retiring debt free, let’s look at the hypothetical illustration below using amounts from real life examples:

This is a typical scenario, the total Fixed Debt + Total Lifestyle Expenses = $3,997.32, now when you do the math, in this example the money will run out in just 8 years, 4 months, and then what do you do? Everyone has seen the elderly folks at the fast food restaurants or passing out shopping carts. Do you think they are there because they want to be there, or do you think their money ran out? They used up their nest egg!

With NO DEBT, using the numbers from above all you have are Lifestyle Expenses of $1390.74. Now when you re-do the math, the money will last for OVER 40 YEARS!

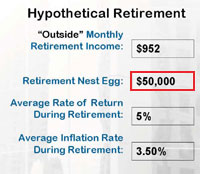

But, what if you didn’t save that much for retirement? Here is another example, but this time the nest egg is a more meager amount, typical of not planning for retirement:

This time when you do the math it is not good news at all, it’s pathetic! In this example the money only lasts 1 year, 5 months before you are saying, “You want some fries with that, Sonny?”

But with no debt the money will last for 10 years, 8 months. Are you starting to see the big picture about dragging debt to retirement? CAUTION: Beware of DEBT in Retirement!

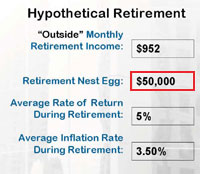

Again using the number from the example above, suppose some adjustments were made in the Lifestyle Expenses and $300 was trimmed off of the monthly expenses:

If you still had debt you could stretch the money to 1 year 7 months, only 2 months longer than before.

Without debt, cutting the Lifestyle Expenses by $300 per month would stretch that little nest egg out for 40+ YEARS!

If you are saying to yourself, "Why didn't I learn this stuff in school?" don't feel bad. They generally don't teach this sort of stuff in high school, and you'd have to major in Finance or Accounting to learn it in college. In high school we are taught how to dissect frogs, but never taught the essentials of money management; skills as elementary but as important as balancing a checkbook just never even gets mentioned. So, when is the last time you dissected a frog?

The Financial Framework Seminar Series™ is here now to fix that. Our system is different. The FFSS is the most comprehensive system ever developed. Not only do we teach families how to get control of their finances and plan for their financial future, we also provide the tools and products that they need to achieve those financial goals. We go one step further, we teach them how to use the tools, plus we provide them with an actual plan and a detailed debt pay down schedule. There are no theories, slogans or complicated formulas that they have to figure out on their own.

The FFSS incorporates several integral components: the 8 Seminar Series sessions, The Equity Creator® Financial Blueprint, The Equity Creator® Budgeting system (and other web based resources), and the Equity Creator® Coaches. We use the term system, because that is exactly what it is. It is a system that takes a holistic approach to the underlying factors that get families into trouble and then provides the real solutions to get them in control of their total financial health. Everything a family needs to know about money, financial management and financial planning is taught in the eight sessions of the FFSS.

Why Choose This Program? This not your typical "Debt Diet" that you see and hear advertised on the airwaves. The Equity Creator® System is customized using your own numbers with the main tool being your personalized Equity Creator® Financial Blueprint. Your Blueprint will show your Financial Freedom Date. You will know the month and year you can be totally debt free, including your mortgage, while spending your same monthly payments!

Proverbs 24:14 - Know also that wisdom is sweet to your soul; if you find it, there is a future hope for you, and your hope will not be cut off.