Financial Lifebook Session Details

Session 7

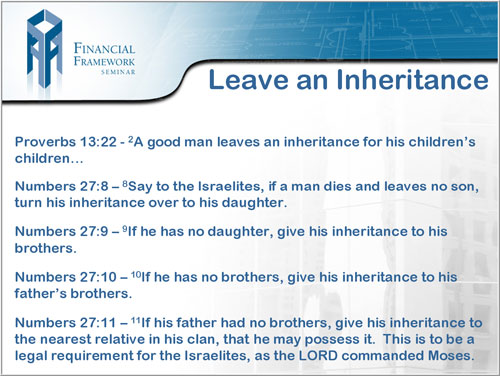

Estate Planning, Giving, and Leaving a Legacy

This session is about Wills and leaving a Legacy. A will is a legal document that states a person’s wishes regarding the transfer of separately-owned property at death, the care of dependents, and the administration of the estate. If an individual dies without a valid will, called intestacy, the laws of the state in which they reside will dictate who gets their property, raises their children, and who will settle the estate. A recent study concluded that 40 percent of the people dying with estates to administer did not have a will. In this session we will discuss: the importance of having a will, having updated and accurate family documents, understanding your homeowners insurance policy, having an accurate household inventory listing, the importance of knowing and maintaining your credit, the importance of tracking your social security information, and knowing what types of documents or family information are considered Vital Family Records, and much more.

What is charitable giving? How does charitable giving affect my finances? In this session we will discuss:

In this session we will discuss:

• The concept of charitable giving.

• Tax considerations when making donations.

• Determining what type of charitable giving may be right for you and

your family.

Donations can be physical or financial and can be given to churches, community groups, or numerous other non-profit organizations. As you probably know by now, it is better to give than to receive and we will explore what you can accomplish using the Equity Creator® Financial Blueprint.

• What would your church be like today if the congregation was either

out of debt or on their way to being debt free?

• How would the building fund or out reach program look?

• What could your church do for your surrounding community and

even worldwide?