Tools to Be Debt-Free

Equity Creator® Financial Blueprint

You might ask yourself, what is unique about what has been covered thus far? Are there any differentiating features between the Financial Framework Seminar Series™ and the rest of the get-out-of-debt and money management seminars available today? The answer is, a most definite YES!

Personalized Financial Blueprint

Each family enrolled in the FFSS gets their own personalized Equity Creator® Financial Blueprint. Your Blueprint contains all the information you need to accomplish your financial goals and dreams. It will show where you currently are financially and what you will need to do in order to build your financial house and successfully reach your Financial Freedom Date on or before schedule.

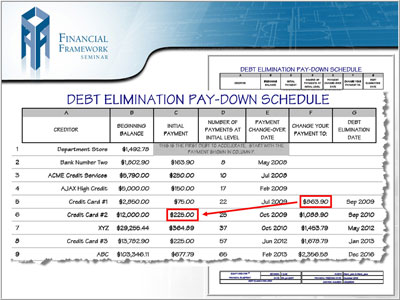

The Blueprint is a financial plan that covers your debt, emergency fund, insurance, retirement, and also includes a customized debt pay-down schedule. The debt pay down schedule takes all of the guesswork out of paying off your debts, and completely removes any need for theories or complicated formulas on how to get out of debt. This is one of three tools you will have access to in order to make sure you accomplish your dream of being debt free!

Customized Debt Pay-down Schedule

The personalized Equity Creator® Financial Blueprint is a total financial plan which also includes a customized debt pay-down schedule.

Program Summary Page

The personalized Equity Creator® Financial Blueprint will summarize where you currently are financially against where they could be if you follow your Blueprint to completion. It is your step-by-step roadmap to your future. Notice you will continue to spend the same monthly payment in both examples and you will not have to sell your belongings to accomplish the task of being debt free and financially secure!

All of this is done while spending your same monthly payment!

Which column would you pick...RED or BLUE?

How many people do you know who are totally debt free?

The Potential Interest Savings is $117,249.54! This is money you have already obligated yourself to pay!

You will get out of debt 19 years and 7 months earlier and based on what you are paying out each month, and you will save $586,870 in monthly payments that was going to your creditors!

Once you are out of debt in 9 years and 5 months, if you continue to save your monthly payment ($2,497.32) for retirement, you would have $1,590,547 in your retirement account at the end of the original time you would have been in debt. This is a $1,299,673 difference at retirement age. Without using the personalized Equity Creator® Financial Blueprint, your creditors would have made this profit!