In this Section

One Huge Money Mistake

What can the Financial Framework Seminar Series™ teach you?

If you really didn’t take the time to read through the descriptions of the 8 Sessions, please do so.

You will see that the FFSS teaches you everything you need to know about money, how it works, how to manage it and many things you’ll probably be upset about once you find out.

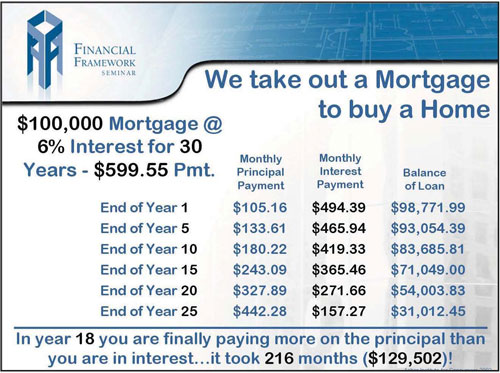

As an example of one of the most costly and common mistakes ever made with money, let’s examine the mechanics of a run of the mill, 30-year fixed mortgage, after all, it is an American dream to own our own home! The problem is that most of us do not have the means to pay cash up front for a house. So, we take out a mortgage. We are usually so excited about qualifying for our loan and being a homeowner that we will sign almost anything. At the closing table, we look at the Good Faith Estimate and see that we are borrowing $100,000 and we will have to pay back $215,838. This does not even faze us.

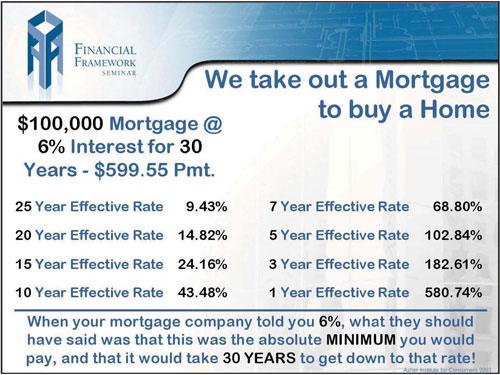

Before we look at the example, let’s consider the following: the average consumer keeps a home for seven years. In today’s climate, we are refinancing every three to four years. So, in essence, we are basically paying interest for years and years without touching much of the principal. Here is the point we want to make: Are you really paying only 6% interest?

During the first few years of your mortgage, 98% of the payment goes toward interest and only 2% towards the principal. After 10 years, you could still owe almost 90% of the original balance. In fact, in the 10th year only $1,249.44 of the annual payment goes to the principal. The other $5,945.16 goes to interest! Your principal and interest payments do not come close in amount until about the 15-year mark. It takes 18.5 years before the amount going to the principal exceeds the amount going to interest. In the 223rd month of the $599.55 principal and interest payment, $298.31 is still going to interest and finally $301.24 is being applied to the principal.

It takes just over 21 years before the balance drops below 50%. Your original mortgage was

$100,000 and after 21 years, the balance is down to $49,938.62. After 26 years, the balance

is finally down to ¼ of the original balance, which is $24,582.88. By this time, you have made

$188,858.25 in monthly payments! Now what about that great interest rate of 6%?

This seems to be only more bad news:

- The only time you actually pay 6% is in the 360th month of the loan.

- If you settle the mortgage (sell the house or refinance) at the end of the 1st year, your effective rate is a staggering 580.74%.

- At the end of the 7th year, the effective rate is 68.80%.

- At the end of the 10th year, the effective rate is 43.48%.

- At the end of the 20th year, the effective rate is 14.82%. Asher Institute for Consumers 2003

- At the end of the 25th year, the effective rate is still 9.43%.

Now, wouldn’t you like to know the rest of what the FFSS™ has to teach you?