Tools to Be Debt-Free

EC Budgeting System™

What is the EC Budgeting System™?

The combination of your EC Budgeting System™ with the personalized Equity Creator® Financial Blueprint is different than any other budget that exists in the market place. The entire concept is designed to put you in control of being debt-free in 8 to 12 years and knowing where all of your hard earned money is being spent along the way.

You accomplish this by being aware of how your money is being spent or in some cases wasted. Unlike the old fashioned budgets of the past, where all of your money is put into one account, the EC Budgeting System™ utilizes two different checking accounts. Your fixed debts such as your mortgage, auto loans, credit cards, student loans, and any other contractual debt you have obligated yourself for, we will call your Budget A account. These bills will be paid from your Budget A checking account. Each time you receive your paycheck, you will need to put the required amount needed to cover these fixed debts into your Budget A checking account. The remaining money will be deposited into your Budget B checking account which you will use for your non-fixed expenses such as groceries, utilities, gas, etc. These are your living expenses that vary from month to month and can never be paid off.

Why two checking accounts?

When your pay checks are deposited into only one checking account, whether you are working with a budget or not, it becomes very difficult to effectively manage your money throughout the month. If you do not work with a budget, there is no way to track your spending and to prevent your fixed bill money from being spent in other areas during the month. Therefore, you may end up spending money allocated for fixed expenses or entertainment. If you have money in the account, it is tempting to use it. Think about your spending habits during vacations or busy weekends when the family is having fun. During these times, it is harder to prevent yourself from spending money that you will later need to pay fixed expenses. This is a pattern that will eventually have a negative effect on your credit rating and could lead to worse problems down the road.

As you prepare to start your EC Budgeting System™, first check with your current bank to see if they offer a free checking account. If not, you may choose another bank (preferably a Credit Union) that offers a free checking account and open your new account.

When you purchase a Financial Framework Seminar Series™ kit, it includes the paper version of the EC Budgeting System™.

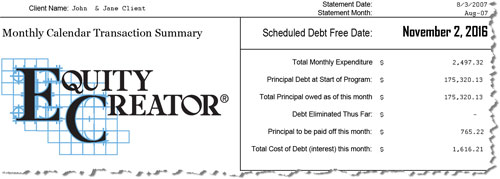

Your personalized Equity Creator®Financial Blueprint by itself is a tremendous tool and is your plan or road map in your quest to become debt free. As you have seen in your Blueprint, your customized debt pay-down schedule is complete from the month you begin until you make your last payment to become debt free.

There is no guessing, no complicated formulas, and no theories or catchy slogans to try to figure out. Their debt payoff numbers are calculated for them and they do not have to sell their possessions to accomplish their quest to become debt free! Your members can log in to their secure account and make any necessary changes to their debt information (add or take away debt, change interest rates, or even add or take away creditors), and immediately have a monthly statement emailed to them showing exactly how much money they need to send each creditor to get out of debt on their Financial Freedom Date that is listed on the cover of their Blueprint.

The EC Budgeting System™ is the first upgrade for you to consider if you need some added flexibility and communication along the way. The monthly statement will coach you along. As a mentor guides you through the process of accomplishing your goals, the monthly statement will show you exactly how much you need to send each creditor each and every month until you become debt free.

The process is powerful and will help you stay on track with real information such as:

- Your original balances where when you entered the system

- What your current balances are

- How much of your money is going to pay off the principal

- How much is going to interest

- How much you need to send next month to each creditor in order to get out of debt on your Financial Freedom Date

- The month and year you will pay off each debt

The process is also very simple:

- You log into your account with a secure password

- You make any necessary changes in your debt information such as: adding or taking away creditors, changing the balances or payment amounts and interest rates

- The Equity Creator®System will then run tens of thousands of calculations to determine the most efficient way for you to become debt free

- A new statement will be generated with the updated information and emailed to you

- If you make no changes in a particular month, the program will generate an updated statement automatically and email it to you on the first of the month